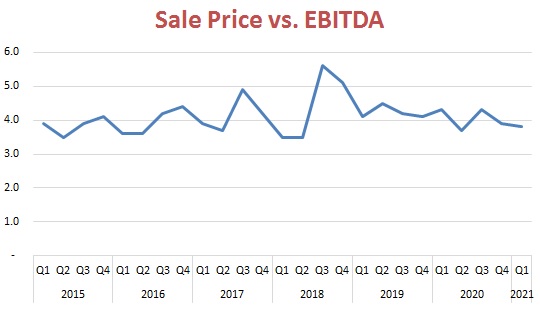

The median price-to-EBITDA multiple among deals reported to DealStats fell slightly to 3.8 during the first quarter of 2021, down from 3.9 in the fourth quarter of 2020, suggesting transaction prices remain under pressure from the coronavirus pandemic.

According to the latest edition of DealStats Value Index, the four-quarter average EBITDA (earnings before interest, taxes, depreciation and amortization) multiple for the year ending in March 2021 was 3.9, the lowest such average since the period ending in the third quarter of 2016.

EBITDA measured as a percentage of net sales fell to 10 percent in the first quarter of 2020, due at least in part the ongoing economic toll of the pandemic and resulting restrictions. The reduction also reflects a longer-term trend of lower margins. EBITDA margins for transacted businesses have fluctuated between roughly 10.5 percent and 12 percent since late 2018, according to DealStats. From 2015 to 2018, they generally moved between 11 percent and 14.5 percent. DealStats does not indicate if the EBITDA margin metric is a median or an average.

Transaction reporting appears to have slowed with the pandemic. Of 15 sectors tracked by DealStats, just three met the minimum of 10 reported transactions during the first quarter required for the inclusion of sector-specific multiples.

DealStats is a database of private-company transactions maintained by Business Valuation Resources. The database is used by business appraisers when applying the market approach to valuation. Multiples such as sale price-to-EBITDA can be derived from transactions involving similar businesses and used to estimate the value of a company, subject to adjustments for unique characteristics of the business being valued.