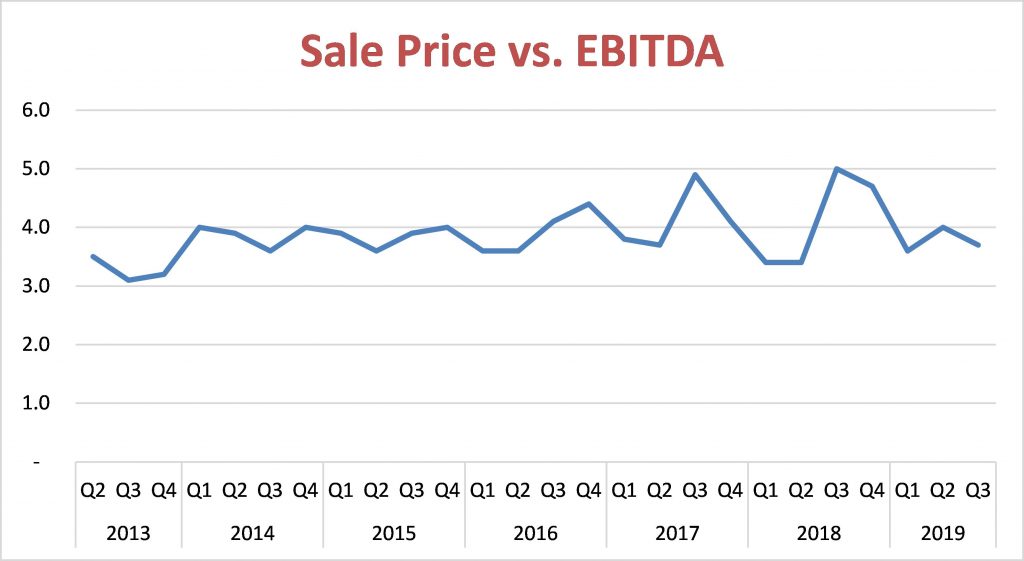

Small business sales during the third quarter of 2019 yielded EBITDA multiples about 26 percent lower than a year before, according to the latest edition of DealStats Value Index. It’s one of several developments noted in the report that point to an emerging buyer’s market.

The median EBITDA multiple – the ratio of selling price to earnings before interest, taxes, depreciation and amortization – slid to 3.7 for transactions completed in the third quarter, down from 4.0 during the preceding quarter and the peak of 5.0 reached during the third quarter of 2018. The EBITDA multiple during the third-quarter of 2018 was the highest quarterly mark since at least 2013.

DealStats is a database of private-company transactions maintained by Business Valuation Resources. The database is used by business appraisers when applying the market approach to valuation. Multiples such as sale price-to-EBITDA can be derived from transactions involving similar businesses and used to estimate the value of a company, subject to adjustments for unique characteristics of the business being valued.

Over the longer term, DealStats notes that EBITDA multiples have generally trended downward since 2017, falling to a six-year low in 2019.

It’s important to bear in mind that DealStats data only reflects transactions reported to the service, and the data is subject to revision as additional sales are reported. For instance, the median EBITDA multiple for the April-June quarter was initially reported as 4.2. That was revised to 4.0 in the latest report. The spike to 5.0 during the third quarter of 2018 was previously reported as 4.4 and 4.5.

The delays in reporting may limit the value of information regarding trends gleaned from the quarter-to-quarter gyrations of multiples.

EBITDA margins decline

Businesses sold in 2019 have tended to be less profitable than those sold in recent years, according to the DealStats data. The median EBITDA margin (measured as a percentage of revenue) was just below 11 percent during the third quarter, up slightly from the second quarter, but down from 12 percent in the first three months of the year. EBITDA margins have generally trended lower since 2013.

A long time to sell

Businesses are taking longer to sell, according to DealStats. The median number of days for private businesses to sell was 221 for deals closed during the first half of 2019. That marked the fifth straight half-year period (dating back to the first half of 2017) where the median exceeded 200. From 2013 to 2016, the median never topped 200 days.

Revenue multiple falls

DealStats reports that the median sale price-to-revenue multiple this year is 0.45, down from 0.49 in 2018 and the lowest multiple in at least a decade. Businesses in the finance/insurance sector garnered the highest multiple, at 1.75, followed by information at 1.70 and professional, scientific and technical services at 0.89.

The highest EBITDA multiple was noted in the information sector, at 11.1, followed by mining, quarrying and oil and gas extraction, at 8.5. The lowest multiple was 2.6 for the accommodation and food service industry.

Business valuation professionals use transactions such as those collected by DealStats to derive a business’s market value. If you have questions about how comparable sales influence the value of your business, or how much your business is worth, please contact us.