What’s the difference?

A few years ago an attorney asked me to review a business appraisal of a sole practitioner law practice in the context of a divorce. The report was prepared by a CPA with no valuation credentials, and who served as the accountant for the attorney/husband. The CPA calculated the value by applying an “excess earnings method.” To do so each of the practice’s assets are valued, and the return on each is estimated. Any excess earnings over the expected return on the valued assets are capitalized by a rate of return to estimate the goodwill value of the practice, which is then added to the value of the assets, net of any debt, to determine the total value of the practice. The CPA’s conclusion? The law practice was worth $108.64. The conclusion was very precise. But was it accurate?

Accuracy describes the “nearness” to a true value. The closer to the bull’s-eye one is when shooting at a target, the more accurate the shot.

Precision, on the other hand, is the degree to which several measurements provide answers very close to one another and indicate the scatter of data – the lesser the scatter, the higher the precision. But preciseness does not create accuracy. Let’s go back to the bull’s-eye example. If I shoot five arrows and all of them land in the upper right quadrant in the outer ring of the target, my shooting was very precise, but I wasn’t very accurate.

Want a numbers example? Suppose I want to determine the average profitability of all restaurants in my community (and let’s assume all restaurateurs are willing to discuss the same with me). If I call five restaurants on Monday morning and calculate the average profitability down to the penny, I’m very precise in my calculation. But am I accurate? Do all restaurants tend to show the same level of profits?

Let’s look at just one factor. Many restaurants are closed on Mondays, choosing to be open all weekend. Can I assume those restaurants are similarly profitable as those that are open on Mondays? Chain restaurants typically are open 7 days a week. Locally owned, private restaurants are the ones that are most likely to close on a Monday. Fast food restaurants are generally open 7 days a week. Higher-end white tablecloth restaurants are more likely to be closed on Mondays than fast food restaurant chain stores. My sampling method assumes all types of restaurants have similar levels of profitability, but if I exclude all the restaurants that are closed on Monday, my average of the sampling may be very precise but not very accurate if my assumption about “sameness” is incorrect (and it probably is).

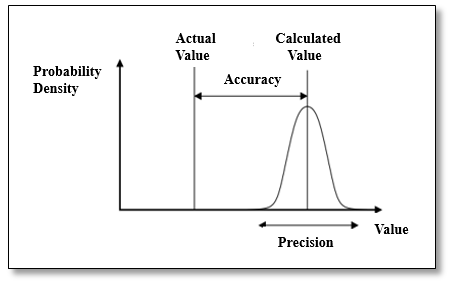

If we look at the issue in terms of statistics, the graph at right illustrates the difference. Let’s assume the “actual” value represents the true, intrinsic market value of our appraisal subject. The closer our value indication is to the actual value, the more accurate our conclusion. On the other hand, we may observe market data and find very little “scatteredness” in the data – statistically speaking, the coefficient of variance is very low. But if we’re observing the wrong data, even though our analysis of it implies precision, we won’t be very accurate.

Don’t be fooled into assuming that precision implies accuracy. It doesn’t. In fact, in my experience preciseness is often used to mask inaccuracy. In an appraisal, a highly precise conclusion of value causes me to double down in my evaluation of its accuracy.