There has been a lot of talk about the tax law that has been signed into law and is in now in effect, mostly in terms of who benefits and what impact it will have on the economy and the Federal deficit. But the new tax law also impacts the value of businesses and may explain a good portion of the run-up in public stock prices. How? There are three basic drivers to value: Returns, Growth, and Risk. The new tax law directly impacts the first drive, returns, and indirectly impacts the second driver, growth.

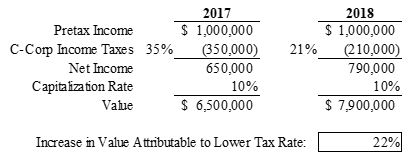

Under the new tax law the corporate tax rate has been reduced from 35% to 21%. From a value perspective, this translates into higher company after tax profitability. For example, a company that reports pretax profits of $1 million will have net income (after taxes) of $790 thousand under the new tax law – up from $650 thousand under the old tax law.

How does this impact value? The following simplified computation illustrates the impact. For illustration purposes, let’s assume a required rate of return for the business (or capitalization rate), which captures risk, is 10%. That is, investors demand a 10% return on this investment based on the perceived risk in the profits continuing, given some expected growth. Under the 2017 tax rate of 35%, that implies a value of $6.5 million. But with a lower tax rate of 21% in 2018, that value goes up to $7.9 million, or a 22% increase in value resulting from lower tax rates.

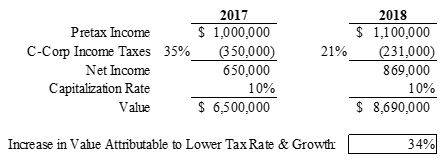

But wait, there’s more. If tax cut proponents are to be believed, lower taxes, both personal and corporate, will spur economic growth as individuals and companies have more after tax income to spend. Increased demand increases business activity and businesses have more profits after taxes to reinvest. So let’s assume that profits grow 10% as a result of stronger economic activity. Pretax profits grow from $1 million to $1.1 million and net income (after the lower tax rates) grows from $650 thousand to $869 thousand. (see below). That implies an increase in value of 34%!

What about other businesses that have some sort of pass-through tax status such as S-Corporations, LLCs and partnerships? While after tax profits will go up, the new tax law is not nearly so clear on how much, though it will likely not be near the reduction available to C-Corps. Consequently, increases in the value of pass through tax entities need to be considered on a case by case basis.